Today we’re launching the iFund blog. The purpose is to share (and hear) perspectives around the iPhone and emerging open mobile ecosystem. We’ve been blown away by the amount of entrepreneurial activity in mobile since launching the iFund on March 6th. In 6 months, we’ve received over 2700 plans. To put it in context, that’s about 20x what we received in a similar period last year. Out of that group, we’ve funded five companies totaling more than $30M of investment:

- Pelago – social discovery and location sharing through an application called Whrrl which is live on the AppStore

- iControl – a home automation and monitoring solution available in Q1

- ng:moco – iPhone games launching its first titles this month

- GOGII – A new social interaction and marketing platform, launching in Q4

- An unannounced venture launching in Q1

We’re excited to be working with these five iFund companies and we’re in active conversations with many others.

The purpose of this blog is to create a forum for dialogue around the impactful trends and observations as the promise of open mobile is being fulfilled. From time to time, we’ll have various KP partners and execs from our mobile companies contribute to this blog which should broaden the scope and perspective.

This first entry seems timely as we come out of CTIA Fall. It’s a good time to reflect on the last year and the dramatic changes we’ve already seen and those afoot across the mobile industry.

- First and foremost… the iPhone. In a word, “Wow!” 1M 3G devices in 3 days and an estimated 6M in 7 weeks.

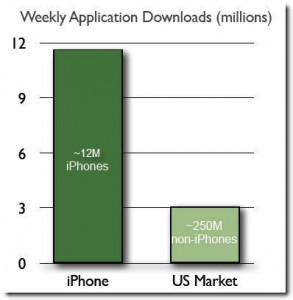

- Second, the astonishing success of the AppStore. “Double Wow” and an even more impactful event for the industry that demonstrates the promise of simple discovery and consumer choice. 60M downloads in 30 days. And hot off the presses 100M in 60 days! According to our estimates and M:Metrics data, that’s more iPhone application downloads in 30 days than all US carriers combined have in a quarter.* That means a relatively small base of handsets (~12M, mostly US) is dramatically outperforming the other 250M.

Is it the early adopters? Is it the iPhone’s great UI/screen/device? Is it the AppStore? Is it the developers and draw of a great development environment? It’s all of the above, but most importantly it illustrates what is possible. The impact of openness is now undeniable. The keys: open the mobile eco-system, solve the discovery problem, and deliver great apps…users flock to download them.

Developers for the first time have been given a great SDK and powerful platform to deliver to, but the bigger impact is the direct access to consumers with a clear set of business rules (free = free and 70/30 revenue split). This leads to developers coming forward in droves. No more building apps and spending 12-18 months to get carrier business deals. On the consumer front the data is dramatic. When you give users choice and solve the discovery issue (make it easy to find, read reviews, and quickly download) we’ve seen people downloading on average ~8 apps/user for every user in the first 30 days! This compares to <25{718561bceb1067ae5e9182be8adb9d8d4717694ce337e91f2ef425f2d4ae2429} of users downloading apps on other devices and downloaders on average having 2.5 apps/year.

Is it game over for every one else? It depends on how others respond. The opportunity is even clearer, but reaching that goal is the hard part for many industry participants. Apple has set the bar extremely high with a beautifully integrated hardware, software, and distribution system. The iPhone is a driving force that is finally pushing others in the mobile ecosystem (from developers to handset manufacturers to carriers) to move faster. Ultimately this is better for everyone as users do more on their phone, buy data plans, transact, etc.

Telecom CMOs are getting pressured by CEO’s asking what their answer is to the iPhone, where are all our cool apps? Brand and media companies CMO’s better have an iPhone strategy as their CEO’s are calling too. It’s been interesting to see brands as varied as Chanel, Lenovo, and Audi develop iPhone apps to address consumers. A different, but very interesting form of marketing.

While these changes have been dramatic, we have only seen the first few pitches of a 9 inning game. The iPhone has changed users’ expectations of what is possible in a mobile device and UI and the AppStore finally showed the promise of mobile data applications. This is good for the mobile industry at large and particularly for the consumer who has never before had the choice the iPhone now provides. As investors, we’re enthused to see developers and entrepreneurs embracing mobile knowing there is a clear path to the consumer. As long time partners with carriers, it’s great to see them moving faster to embrace open models such as T-Mo’s application store, VZ’s developer conferences, AT&T’s partnership with Apple, Sprint’s open developer program, etc. All industry constituents are innovating faster. The choice of applications and how to access them will be the fastest evolving area over the next few months.

The next waves to watch are: 1) the execution of incumbent operators as they embrace open and deliver application stores and 2) an even more sophisticated set of applications from developers on the iPhone.

#1 was the hot topic at CTIA and we were impressed with how fast many carriers are “saying” they’re moving to a model which allows any app developer to reach their subscribers. Now it’s about following through. The risk is that many elements have to come together well for them to achieve success (handsets, OS, UI, effective storefront and merchandising, etc.). In addition, working with closely with developers has not been a core competency.

#2 is already in evidence as the recent apps on iPhone are already half a generation ahead of the apps that launched in July. After all, the iPhone SDK has only been available for 6 months! We know some of the apps in the pipeline will take things to a whole new level. And the volumes are clearly there, with some apps in these early days already reaching 1-2M downloads.

Stay tuned for a future conversation on mobile monetization and navigating the trade-offs of free versus paid applications.

* (250M devices X (20% downloading games + 5% who download apps) X 2.5 apps/phone) = 150M downloads/year = 37.5M/Q; excludes ringtones, music, and wallpapers – content that is more similar to iTunes purchases than AppStore downloads. Sources: M:Metrics, 1/31/2008 Survey of U.S. mobile subscribers, n = 31,389 and Apple Inc.